If you’re applying for disability benefits, one of the first questions you probably have is:

“How much money will I get each month?”

Whether you’re applying for Social Security Disability (SSD) or Supplemental Security Income (SSI), the answer depends on a few key factors — including your work history, income, and living situation.

In this post, we’ll explain how benefit amounts are calculated for each program, what the average payments are in 2025, and what could increase or reduce your monthly check.

How Much Will You Get on Social Security Disability (SSD)?

SSD (also known as SSDI) is based on your work history — specifically, how much you’ve paid into the Social Security system through payroll taxes.

✅ What Affects Your SSD Benefit Amount?

- Your average lifetime earnings before you became disabled

- How many years you worked

- Whether you receive other public disability benefits (like workers’ comp)

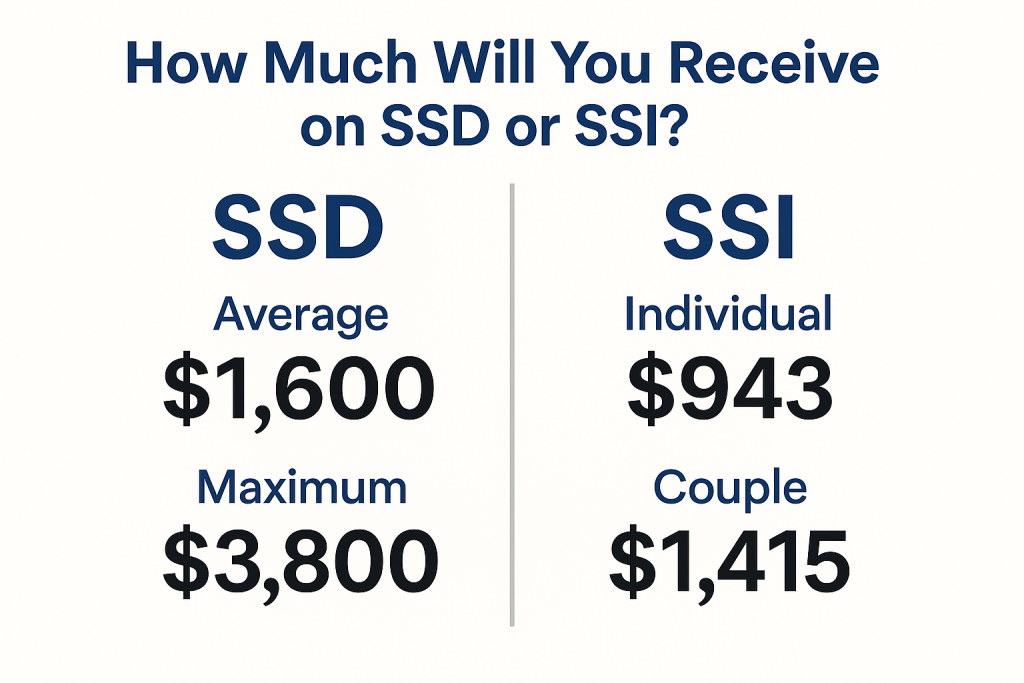

💵 Average SSD Payment in 2025:

- The average monthly SSD payment is about $1,600

- The maximum monthly SSD payment is about $3,800 (for high earners)

💡 You can check your estimated SSD benefit by creating a mySocialSecurity account at ssa.gov/myaccount.

Can SSD Be Reduced?

Yes, in some cases. Your SSD payment could be reduced if:

- You’re receiving workers’ compensation or other public disability benefits

- You owe child support, alimony, or certain federal debts

✅ Private disability insurance and VA benefits do not reduce your SSD payment.

How Much Will You Get on Supplemental Security Income (SSI)?

SSI is a needs-based program for people with very limited income and resources — and the payment amount is based on federal guidelines, not your work history.

💵 Maximum SSI Payment in 2025:

- $943 per month for individuals

- $1,415 per month for couples

That’s the federal base rate, but your actual payment may be lower or higher, depending on:

- Other income you receive

- Help you get with food or housing

- State supplements (some states add extra money to the federal SSI check)

What Can Reduce Your SSI Payment?

SSI is affected by almost all income, including:

- Wages from part-time or temporary work

- Free housing or food provided by friends or family

- Other benefits (like unemployment or VA pensions)

✅ Social Security will reduce your SSI payment dollar for dollar for most income you receive, after a few small exclusions.

Can You Get Both SSD and SSI?

Yes — in some cases.

If your SSD benefit is very low (because you didn’t work much or earned low wages), and you meet the financial requirements, you may qualify for SSI as a supplement.

This is called “concurrent benefits.”

What About Back Pay?

If you’re approved for SSD or SSI after a long wait, you may also receive back pay, which covers the months (or even years) you were disabled but waiting for your claim to be approved.

✅ SSD back pay can go back up to 12 months before your application date

✅ SSI back pay starts the month after you applied

Final Thoughts

Your monthly SSD or SSI benefit depends on:

- Your work history (for SSD)

- Your income and resources (for SSI)

- Whether you receive help with living expenses or other public benefits

While SSD tends to pay more than SSI, both programs can provide essential support if you’re unable to work due to a disability.

If you’re unsure what you might qualify for — or how much you’ll receive — consider checking your Social Security account online or speaking with a disability expert. They can help you understand your estimate and make sure you get every dollar you’re entitled to.